Beginner questions answered

Cryptocurrency is quite a buzzword these days and many people wonder, how cryptocurrencies gain more value. We answer this question here in a roundabout way and explain, why the term cryptocurrency is a distraction and why focussing on bitcoin is the only thing that truly matters.

Bitcoin was the first crypto currency: Launched in early 2009, it has gained a tremendous following since then and many of bitcoin’s aspects have been copied by other cryptocurrencies. Bitcoin, is in essence a digital asset, initially created to act in a similar way as we use traditional fiat currency (like the Dollar or the Euro) today, but without the inflation problem that fiat currencies have. If there is one thing, that most people know about bitcoin and other cryptocurrencies, it is that they have been and still are quite volatile in terms of exchange rate to legacy fiat currency.

I often get asked the question by friends, family and co-workers (because I am the “crypto guy” in their mind): How does bitcoin (or cryptocurrencies) gain more value? It is an understandable question because we have all heard about the multiple cases where people have claimed to make millions during a crypto boom (we all see our social media feeds flooded with these headlines) and suddenly they have lost it all when the cryptocurrency they have invested in has gone downhill.

So how does bitcoin gain value?

Bitcoin is money. It is the best money in human history because it has properties which make it such. We explain the properties further down, for now, let’s just think of bitcoin as money. And just like traditional currencies, bitcoin has and gains its value as a collective idea of users, who use it as money. The exchange rate from the dollar to bitcoin is essentially based on a supply and demand-relationship (in this case, the scarcity of coins for sale).

Obviously, demand will increase the more useful bitcoin is and the more people use it as money. Adoption has steadily increased over time. At the same time, supply is coming down over time, because bitcoin has a fixed supply schedule and new issuance decreases over time. 90 percent of the total bitcoin supply that will exist is already circulating and only 10 percent will be added to the supply over the next 120 years. It’s that simple: Increasing demand, decreasing supply: Bitcoin becomes more valuable over time.

In order to further and better understand why bitcoin is valuable and how it gains its value, we need to first briefly understand what fiat money is and how it has evolved until today.

What is fiat currency and why it doesn’t hold value over time?

Fiat money is the national currency that we are used to use today, e.g.: U. S. Dollar, Euro, Japanese Yen, Australian Dollar and their supply is controlled by what is called a central bank, a supposedly independent entity which determines how much and when to print more money depending on their political goals and overseeing monetary policies. Sounds complex. Let’s break it down:

In essence your fiat money is worth as much as the government which is behind it is behaving responsibly. It is a very fragile system, because all fiat currencies in history have failed eventually, except for the currently used fiats, which will likely also fail at a time in the future if history repeats or rhymes.

Earlier in time, the dollar was backed by gold, which means that its value was directly linked to the value gold until 1971 when the so called “gold standard’ was abolished by Nixon in what is known as the “Nixon shock” today. Nixon went in front of TV cameras on the night of Sunday, August 15th, 1971 and said that he would “… suspend temporarily the convertibility of the dollar into gold …”. This temporary measure is still in place today, more than 50 years later. Currently the dollar is “backed” by the US government treasury. So in essence by nothing: Dollars are unbacked government promises. Dollar bills are, fundamentally speaking, without any value.

And just like the U.S. Dollar, the rest of fiat currencies work in the same way. None are backed by anything; they are pieces of paper and digits in computer databases with a central banks and commercial banks manipulating the supply via constant supply increases. Because of these constant supply increases, value of fiat currencies errodes over time.

The dollar then and other fiats has value because people accept that it has, not because it is pegged to something or because value arises out of a property it has. It does not have value because the government says so. It has value because people use it as a medium of exchange within the United States (and outside). Money is an idea and value arises whenever people assign it value.

Why is bitcoin so valuable and how does this cryptocurrency gain its value?

The cryptocurrency bitcoin has several properties, which give it value. This is the first point as to why “the crypto” bitcoin is the way to move forward and why it is valuable and gains value:

- Bitcoin is money

- The user base of bitcoin the technology uses individual units as money. Thus, moneyness arises in the minds of bitcoiners, who use it as such. (I am an example of such a user, as is my wife).

- Hard capped supply

- Bitcoin has a supply cap. Fiat currency does not. Bitcoins’ capped supply is credibly enforced due to decentralization of the network. There’s only so many (21 million bitcoin or 2.1 quadrillion satoshis) and there never will be more. Bitcoin is perfectly hard money for that reason: It is harder than gold, which inflates at about 2 percent per year over time. Government fiat currency inflates faster at 7 to 10 percent per year, depending on the currency in question.

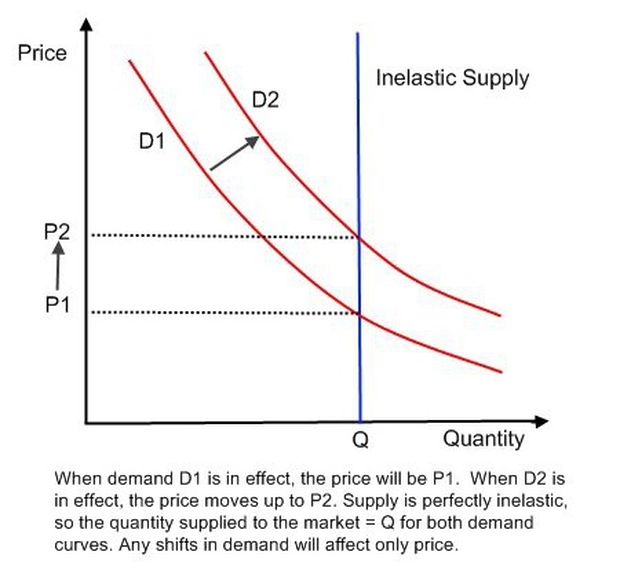

- Supply inelasticity Bitcoin is issued according to a schedule.

- The protocol and network self adjusts to always adhere to the issuance schedule. It is not possible, to extract bitcoin faster via mining even if you try extremely hard. If the exchange rate triples over night and three times more miner come online quickly, the network self adjusts mining difficulty to make it three times harder to find a bitcoin block, thus keeping adherence to the issuance schedule. It is not possible to issue bitcoin more quickly. Bitcoin is the only market good with perfect supply inelasticity.

- Bitcoin is backed by math and physical energy

- This happens via the proof of work mechanism. This code and algorithm works on millions of mining computers around the globe, which makes new bitcoin creation decentralized

- Decentralized

- No one single entity is in charge for mining. That’s the reason why the system is reliable, transparent and secure. On top, any user can spin up a non-mining node and enforce the network rules at home. Many people do adding to the decentralized nature of bitcoin.

- Supply and demand

- It is the basic economic rule there is. Too much demand and low supply will make the price go up! Little demand and a lot of supply will make the price go down! Therefore, scarcity and inelastic supply is the biggest advantage of bitcoin over fiat money.

We’ve mentioned the capped supply: Bitcoin has a set limited supply of 21 million, meaning no more can be created and no more can be printed, whilst fiat is unlimited, and they are increasing alarmingly over time.

Add to that adoption by the market with an increase in users over time, and you’ve got a rocket fuel savings technology, ready to hit escape velocity.

What about other cryptocurrencies

Poker players have a saying: If you don’t know the patsy at the table, it is you.

You noticed that we’ve not mentioned any other cryptocurrencies, because none of them are money. Now, how cryptocurrencies gain value, will be different depending on the cryptocurrencies, as not all of them were born with the same intent. There are about ten thousand cryptos by now and most are frauds or scams. Some might be legit, but the vast bulk was created intentionally to defraud you of your money and to steal from you. Even if fraud was not intentional at the founding of a crypto, it will still be hard to figure out which one of them is legit. Odds are not on our side here. It’s hard to find the needle in the haystack. Only true experts can do it and if you’re asking the question, how a crypto gains value, then you’re not one of those experts. Sorry to be candid here. That’s why it is a good idea for most folks to forget about cryptocurrencies. Think about the poker players.

Premines

Cryptos that are not bitcoin, usually had a pre-mine. That means, tokens were generated by the founders. These tokens were then distributed to the founders and other parties with economic interests, who then sell them to the public. I don’t know about you, but I find that type of behavior highly suspect.

Bitcoin never had a premine. It's launch was fair in a sense that Satoshi published the specification via the whitepaper and later the software, without assigning himself special tokens. From day one, participation on the bitcoin network was open to anybody.

And that’s why I don’t care about any other cryptocurrencies. There’s only bitcoin to me, which is an alternative to traditional money unlike the rest of cryptocurrencies which are not money. Money is a winner take all market. There’s only one Internet money and no room for a second one. Bitcoin had to generate ‘trust’ just like traditional currencies. How? By using a secure and transparent technology and standing the market test for 12 years now.

As we move forward, it is only reasonable to assume that there will be a mass adoption of this best money humanity has ever developed. At the same time, we are witnessing a “once in a lifetime“-type investment opportunity by buying and holding bitcoin. Given that there are not enough bitcoins in the world for everyone to own just one unit, this will increase the demand and therefore increase its value.

The properties and characteristics that make bitcoin sound money

We've mentioned before that bitcoin is money. For completion, lets explain what properties make it so. There are a few characteristics that money needs and bitcoin scores well across the board:

- Durability:

- Money needs to be durable to transmit value through time. It cannot rot away. Bitcoin is the most durable of all the cryptocurrencies and the only one, that is money. It does not corrode, erode or depreciate.

- Portability:

- Bitcoin lives on the bitcoin or lightning network and goes wherever you go. If you control your own keys, you’ve got access to your bitcoin world-wide without asking anybody for permission.

- Divisibility:

- Bitcoin can be subdivided into 100 million units. The smallest unit is called a satoshi

- Scarcity:

- The bitcoin supply is limited. It is perfectly scarce and new supply is perfectly inelastic.

- Acceptance:

- Bitcoin is accepted by more and more merchants every day. It is legal tender in the country of El Salvador. Acceptance for other cryptocurrencies at merchants is non-existent. I challenge you to find a single real world merchant selling goods for alt coins.

- Transferability:

- All Bitcoin transactions are settlements. No credit is involved (unlike the fiat system). Bitcoin payments move at the speed of light, faster than fiat

- Uniformity and Fungibility:

- Bitcoins are fungible. One bitcoin is one bitcoin and one satoshi is one satoshi.

So how well does bitcoin score? It fulfils all 7 of the characteristics, making it undoubtedly sound money. Bitcoin cryptocurrency is durable, portable, since it is informational in nature, highly divisible (into satoshis).

Bitcoin is scarce, with a limited supply of 21 million units, already mentioned above in this post and it fulfils the acceptability criteria based on ‘the trust’ of enough people to confidently state that it is valuable and sound money. It moves fast and is fungible.

Finally, you cannot copy bitcoin: You can copy the code base, but you cannot copy the network infrastructure and the mindshare of the brand. There is no second bitcoin and there will never be a second bitcoin. 21 million is all there ever will be.

One of the most important aspects of Bitcoin is its utility as medium of exchange. This assumes and agreement by enough of people to establish that bitcoin has value and therefore will have practical utility and will appear as a money.

The payment is the settlement

One of the practical utilities of bitcoin is that it is not only harder money than gold, but also faster for transactions than fiat currencies. A bitcoin payment is a settlement.

That’s not the case for fiat money, where credit is involved in every payment transaction. If you buy a coffee with your debit card or credit card, the settlement does not happen in the coffee store while you pay. It happens days later, when your bank settles with the merchants bank.

If you bought a coffee in El Salvador via the lightning network, which is bitcoins second layer, the payment is the settlement. As soon as you pay the merchant, the debt is settled. No banks are involved and there is no counter-party risk.

Summary

When understanding why cryptocurrencies hold value, first you need to be able to detach yourself from the generalisation of Bitcoin being part of the rest of crypto-coins aka ‘alt coins’ or ‘shit coins’ and focus on the reasons as to why bitcoin is so different and valuable. In a nutshell:

Bitcoin’s supply is fixed and the distribution of new bitcoins is also fixed and transparent, information available to anyone. Even the time frame for when the last coin will be issued is predictable from the code today. It is a highly transparent system.

Bitcoin is on the decentralized bitcoin network. It doesn’t have a public face which determines the direction of this currency. This makes it the better money than gold used to be. It is free of authority and government reach to manipulate and print at will and that way it avoids devaluation and depreciation which is so common to fiat currency.

It is location free, meaning it is easily and immediately available to be exchanged across the globe at any given time. The Chinese government has banned it 7 times. The first time they did they banned it, and the next 6 times they’ve told us via their actions that they in fact cannot ban this thing. Read why governments can’t ban bitcoin here.

It is apolitical, meaning it is not designed to favour any social or political system.

It is a decentralised digital asset which has no direct control by a single individual, anyone is able to buy and anyone is able to receive it, it is permissionless, making it free from hyperinflation or oppression.

You have reached the end of How do cryptocurrencies gain more value? Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of How do cryptocurrencies gain more value? This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.