Why is Bitcoin Good for Society?

Bitcoin is very much misunderstood in the press. That misunderstanding might be on purpose or accidental. The effect is the same: If you only look at bitcoin superficially through the mainstream press, you would not get an accurate picture. That’s why I’ve started this blog and today I’d like to answer the question if bitcoin is good for society.

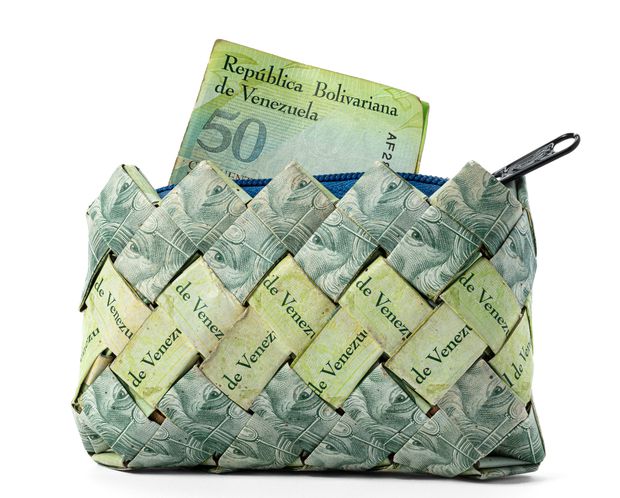

Bitcoin is extremely beneficial for society. That’s because bitcoin is fairer than the fiat dollar alternative. There’s no kleptocracy in bitcoin: The system is fair. Moreover, Bitcoin is vastly more energy efficient than the petro-dollar alternative and bitcoin incentivises alternative energy efficiency, thus lowering emissions. Bitcoin is a system of peace. It removes the possibility for seigniorage thus defunding war mongering governments and incentivising diplomatic solutions for problems. Inflationary currency collapses will not happen in the bitcoin system, which makes the hyperinflationary collapses of Venezuela and Zimbabwe impossible in bitcoinized countries. That’s a lot to unpack:

Why is Bitcoin Important in Society?

Bitcoin is Fair Money

Bitcoin is the fairest money in the history of the world. Because of the decentralized nature of the system, no entity like the Federal Reserve or the European Central Bank can control it. Bitcoin is a set of rules, which is enforced by a decentralized computer network, and every participant in the bitcoin ecosystem must adhere to these rules, if they want to operate in bitcoin. The rules have been in place since 2009 and they are transparent, visible to everybody. Moreover, the rules only changeable via consent of a majority of network node operators. In a sense then, bitcoin is a democracy of bitcoin nodes.

Because the system is transparent and new bitcoin (BTC) are distributed fairly in a meritocracy, the bitcoin money is fair money. There’s a hard cap of 21 million bitcoin, or 2.1 quadrillion satoshis (the subunits of a BTC, 100 million per BTC) and we all know there will never be more. Your savings are safe in bitcoin, and you own a piece of the pie which will never shrink.

The Fiat Dollar is Not Fair

The alternative is the old and outdated fiat system, which is controlled by central banks and commercial banks. In the fiat system, your savings are not safe, because you do not own the same piece of the pie over time. Fiat currencies increase their supply consistently, year after year. That devalues previous fiat units, your savings. Central bankers know that and purposefully steal wealth from you. Christine Lagarde, Head of the European Central Bank has admitted that. She said: “We should be happier to have a job, than to have our savings protected” Huh? I don’t know about you, but I like my savings protected. In bitcoin, they will be protected from Lagarde and her banker friends.

Fiat Causes Consumerism

Instinctively, people understand that fiat money devalues over time, so what’s the point in saving it? In the minds of many, it’s better to spend it now over 10 years from now because 10 years from now, it buys so much less. Consumerism is a result from ever devaluing fiat money. Central banks want to fight climate change now. How do you think that will go with ever expanding currency and inflation year after year? Inflate, inflate, inflate. Consume, consume, consume. I don’t know about you, but to me the contradiction of everlasting fiat inflation and lowering of emissions seems to me incompatible to me.

Deflationary Money for a Deflationary World.

Which brings us straight into the next point: Technological advances are by their nature deflationary. You get more for less all the time. A great example is your smart phone, which is also your camera, your map, your mobile computer for email and social media and even more. 10 years ago, you needed a device for each of these functions. Now you have one.

Inflationary money and deflationary technology do not go together. These two forces are at odds with each other. It has worked until now, albeit poorly but if fiat keeps going much longer, wealth discrepancies will become more and more pronounced. The rich will get richer, and the poor will get poorer in fiat. Bitcoin is leveling the playing field, because it has a deflationary nature that complements deflationary technology advances.

If you want to understand this point better, read the excellent book “The Price of Tomorrow”, by Jeff Booth.

What are the Benefits of Bitcoin for Society?

There are many problems in the world, and bitcoin offers hope on so many levels, fixing many of these issues. Let us look at benefits to society, which come from adopting bitcoin.

Bitcoin Kills Kleptocracy and Lowers the Wealth Gap

The wealth gap is driven by central banking. The richest of the rich have never been richer and the poorest of the poor have never owned less of the overall economy compared to the past. This trend has been in place since 1971, when money went from somewhat gold backed to pure fiat. I suggest you have a look at the excellent website wtfhappenedin1971 to see for yourself what’s been happening to the overall population. Central banking kleptocracy is the direct cause for that. Bitcoin kills central banking and provides a level playing field for all. Adopting bitcoin is superior to society than taxing the rich and staying on the fiat standard would be. That’s because incentives in the bitcoin system reward productive endeavours. Taxing the rich and redistribution incentivises poverty directly and disincentivises productivity. A meritocracy is always superior for outcomes then redistribution would be.

Bitcoin is Honest Money

Because bitcoin is a fair system, there’s no longer room for central banker helping their rich hedge fund friends by leaking inside information for a bribe. Savings are protected and every market participant operates under the same rule set. That alone is worth bitcoins energy expense, which as we will see later is in fact more efficient than the fiat system.

Bitcoin Drives Energy Development

Energy is proportional to human flourishing. The western world has a high standard of living because it uses energy. Bitcoin incentivises energy efficiency and will drive energy development forward.

Incentives for Energy Efficiency

Bitcoin mining relies highly on cheap and abundant energy. The cheaper they can get energy, the more profitable are miners. This incentive for energy efficiency will bring bitcoin mining to energy producers and help them harness previously stranded energy sources. Bitcoin is energy money. More energy means more human flourishing. More human flourishing means a better society for more people by using energy more efficiently and using new sources of energy.

The bitcoin system uses currently 0.1 percent of what the fiat system uses. The fiat system requires gold mining, commercial banking, and military backing. Bitcoin has the runway to increase energy expense 100 fold and still uses only the same amount of energy as the old and unfair system does, making it more energy efficient.

Read more about this in Hass McCooks excellent piece in bitcoin magazine.

Lowers CO2 release of Fuel Operators

Some bitcoin mining is done in the oilfield on oil wells where mining reduces flare gas emissions drastically, providing a better emissions profile for any oil well that mines bitcoin. There is no Methane venting anymore in these wells, all methane is converted to carbon dioxide and water in electrical generators. The electrical generators lower the emissions profile of the oil well, because methane is many multiple times more warming than carbon dioxide according to climate science.

If we look at the total energy mix of the bitcoin network, it is also vastly more climate friendly than fiat. Bitcoin is currently operating on a better energy mix than any country at an estimated 39 % renewable beating the petro-dollar system, who’s military backing is relying heavily on fossil fuels. Bitcoin is the green alternative to fiat, which relies on 84 percent carbon based fuels (source: ourworldindata)

Bitcoin is Peace Money

War is terribly costly in terms of human suffering and devastating to society. The twentieth century was a century of many wars with two World Wars, the Korea War, Vietnam and the first of the two Gulf wars in Iraq to name a few. All these wars were mostly enabled by government control over soft fiat money. On a hard money standard such as the bitcoin standard, war becomes incredibly costly because governments do not have any seigniorage. If war must be financed using hard money, a peaceful solution needs to be found quickly because hard money runs out on a deficit. A world on a bitcoin standard will have fewer and shorter wars or maybe even no wars at all. That’s an incredible advance for human society!

Live Becomes Cheaper Over Time

Live on the bitcoin standard becomes cheaper all the time, because bitcoin is deflationary in its nature and is currently monetizing. Cheaper live means more abundant live for society, which means an improvement in the standard of living for everybody. I practice photography, so here’s a real-life example for what I mean: When Sony released the A7 III camera in early 2018, the introduction price was $2000 or 25,000,000 satoshis (0.25 bitcoin) at the time. Sony has just announced the successor to the A7 III, the A7 IV camera will be released by the end of the year for $2500, a 25 percent increase in dollar terms over the A7 III at release. But if we denominate the new camera in bitcoin, it costs 4,160,000 satoshis (0.0416 bitcoin), which is an 84 percent decrease in introduction price. That’s quite a bit cheaper for a better camera.

Workers’ Wages Increase by Themselves

Assume it is 2035 and the whole world is bitcoinized, operating on the bitcoin standard. Bitcoin has monetized and the astronomical gains in purchasing power have slowed down. You get paid satoshis directly to your wallet by your company and your annual salary is 500,000 satoshis. Technology has advanced a lot and keeps advancing and the cost of living keeps going down, due to the deflationary nature of bitcoin at a rate of about 3 percent per year (just to pick a number for sake of the argument).

If your company keeps paying you 500,000 sats year after year, and prices keep going down 3 percent every year, you would be better off each year without a raise, so much so that after 3 years your salary buys you 9 percent more goods and services. Constant wages and a deflationary money make workers wealthier over time without having to ask for raises. The individual is now in charge with the better negotiating position, no longer the corporation. This fact seems to align with the leftist view of the world, by putting the worker first, and I cannot understand why left politicians around the world would not embrace bitcoin given how bitcoin is making live cheaper for workers. Wages will increase even if they don’t in nominal terms on a bitcoin standard, which will make society wealthier.

Bitcoin Improves Economic Calculation

Economic calculation is important to a properly functioning economy. It seems obvious: Entrepreneurs and businesspeople need to be able to properly calculate or they have a much harder time providing value. Economic calculation is challenging, because the fiat system is no longer functioning properly. Think of all the supply chain issues of 2021 and the shortages in the supermarkets. These are a direct knock-on effect from economic miscalculation which can be traced back all the way to the fiat system.

No Hyperinflation

Bitcoin is a deflationary money. There is no inflation in bitcoin at all past 2.1 quadrillion satoshis. Therefore, there is no possibility of any negative externalities from inflation affecting society. There will never be an inflationary collapse such as previously experienced in Venezuela or Zimbabwe and which is just now happening in Lebanon. People in Argentina have undergone several currency collapses since 1971. Argentina is operating on the 4th currency since then and in every currency collapse, savers have lost the vast bulk of their savings. On a hard money standard such as the bitcoin standard, inflation will no longer negatively affect society and humans will flourish in the 21st century.

Summary

Bitcoin is good for society, because it is fair, free from kleptocracy and fraud, energy efficient and free from inflation making live cheaper with human progress (which is how it should be). We have finally got a money that fits in with productivity increases and which cannot be manipulated by a handful of actors with economic interests. Bitcoin is the bedrock of civilization in the 21st century and will enable humanity to take the next steps in history. Bitcoin fixes money for good. Fix the money, fix the world.

Footnote:

The energy mix of 39 percent renewable is based on the Cambridge Industry Survey.

You have reached the end of Is Bitcoin Good for Society? Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of Is Bitcoin Good for Society? This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.