Is Ethereum a better long term investment than bitcoin?

One Money

Money is first and foremost a technology and humanity has had many different forms of money over the course of history:

- Fiat currency

- Currently, most people live on a fiat currency standard. Fiat currency requires trust in bankers who are ultimately in charge of the money supply. Because human interests can manipulate the supply, Fiat currency is not good at storing value long or medium term and only good for transactional use.

- Gold

- The gold standard was the basis for money in many parts of the world until governments were able to implement the modern fiat paradigm. On the gold standard, money was sound because money supply increases requierd hard work. Gold needed to be dug out of the ground.

- Silver

- During the time of the gold standard, some countries were on a silver standard, with terrible consequences for their long term wealth. India and China are two examples for countries on silver standards, while everybody else used the better money gold. Silver was a poor choice, because it was more abundant than gold and therefore could be dug up more easily, diluting wealth stored in it over time.

- Sea Shells

- Sea shells are an even older example of a technology used for money, which was used by tribes in different areas of the world for a time and then replaced, eventually by much more sound precious metal money, which held value better due to higher scarcity.

What's the point of this list? It shows us, that the current government issued fiat currency "money" is by far not the only possible paradigm for money. There are other possibilities.

It also shows us, that harder monies have won over softer monies over time, because there is an incentive to store wealth in hard money and market forces make soft money lose value compared to hard money.

A notable historical exception, where a soft money has displaced a hard money, is the ability of governments to disrupt the hard money gold and implement a soft fiat currency standard, under which we currently live. This anomaly is based upon the fact that gold tended to centralize over time where it was stored in bank vaults. These storage locations could be corrupted and taken over by governments.

How is all that related to Ethereum vs. Bitcoin, you might wonder at this stage.

If I am right that money is a winner take all market, and if crypto and blockchain will disrupt fiat currency to be the money in this century, then the likely outcome is that one of the two will emerge as victor. Which one is it? We can look into certain properties of bitcoin and Ethereum to see which one would more likely win, and in doing so answer the question which one is likely going to be the better investment.

Monetary Properties. Which Money is harder?

If all else is equal, the harder money usually wins. So let us explore which of the two contenders is harder? Is Bitcoin the harder money or does the "ultra sound" Ethereum win?

The Bitcoin Supply Schedule

Bitcoin was launched in early 2009 with a programmatic supply schedule. Bitcoin is issued to bitcoin miners according to certain rules. The bitcoin protocol is designed in a way to adhere to this supply schedule. On average, new bitcoin is supplied every 10 minutes and the amount supplied is defined in the rules and cut in half every 4 years.

In 2009, 50 bitcoin (500 million satoshis) were issued every 10 minutes and four years later, the new supply was dropped to 25 (250 million satoshis). Another 4 years later, it was 12.5 bitcoin (125 million satoshis) and right now, the reward is 6.25 (6.25 million satoshis). The bitcoin reward will keep dropping over time.

Bitcoin has adhered to the supply schedule for the last 12 years and the total supply is programmatic and limited to just shy of 21 million bitcoin (2.1 quadrillion satoshis). As I type this, 18.86 million bitcoin are outstanding (1.886 quadrillion satoshis)

The Ethereum Supply Schedule

The Ethereum supply schedule is much more complicated, because it has been changed over time diverting from original promises meanwhile. Ethereum does not have a predictable monetary policy, because it has diverted from the supply rules in the past.

If the rules cannot be credibly enforced, why do you believe that they would in the future? Fool me once, shame on you. Fool me twice, shame on me.

Bitcoin is the more credible sound money, because it earned a reputation over its operation history, that the network follows and credibly enforces the rules. Bitcoin works and is sound. Ethereum has deviated from its rules in the past and can do so again in the future. Ethereum is not credible as "ultra sound money" (which is a non-sensical marketing terms, that Ethereum supporters use these days). In terms of monetary properties, I conclude that Bitcoin is sound money and that Ethereum cannot be sound money despite it being marketed as "Ultra sound Money" (what does that even mean?). Advantage Bitcoin.

The Rulers: Who is in charge?

Bitcoin makes in tremendously easy, to run a node. In fact, a node can run on 200 dollars worth of hardware. A raspberry pi 4 and a 1 terabyte hard drive is enough to validate bitcoin transactions.

The bitcoin nodes enforce the bitcoin rules, together in a decentralized fashion. Every node verifies the rules for itself and there are 10s of thousands of bitcoin nodes around the world. Bitcoin is a decentralized system of rules which replaces rulers.

Ethereum does not run on a Raspberry Pi 4 with a one terabyte hard drive, not even close. To run an Ethereum node, you need a much more evolved technical skill set and more expensive hardware. In fact, most Ethereum nodes run on cloud computing infrastructure (AWS, Azure etc.) which can be shut down by the U.S. government with a couple of phone calls.

Moreover, Ethereum has a leader in Vitalik Buterin, who can make changes to the protocol and the monetary policy via his influence. If there's a leader who's in charge, how is the project decentralized? If nodes can be switched of with a couple of phone calls, how is the project decentralized?

Bitcoin is more decentralized than Ethereum. Again, advantage Bitcoin.

Scaling Solutions

Bitcoin has working solutions in place for scaling, today. Scaling is needed to make Bitcoin (or Ethereum for that matter) world-wide money. The base layer of bitcoin is slow and designed for maximum security. It is for high value transactions only.

Scale is achieved on the lightning layer, which is the second bitcoin layer. Lightning allows very fast and permission-less bitcoin transactions from one lightning wallet to another for very low fees. The lightning network is the main driver behind El Salvador's bitcoinization which has shown that bitcoin scaling works and that bitcoin can be used by millions of people.

Ethereum scaling is lacking behind. Today, there is no successful second layer with active user contributiouns based on Ethereum. There are ideas floating around the space, but they have not been shown to work yet.

Bitcoin scales today as demonstrated by El Salvador using lightning. It is today unclear, how well Ethereum will scale. Third advantage bitcoin.

The Ether pre-mine: Is Ethereum an Exit Scam?

Ethereum has had a pre-mine. When the project was launched, initial contributers were issued 60 million Ether and another 12 million Ether went to the Ethereum foundation and their friends. If that smells like cronyism to you and unfair, that' because it is.

The pre-mine beneficiaries were able to sell Ether on the market for bitcoin or for fiat dollars. Bitcoin, on the other hand came into existence without a spendable pre-mine. Technically, the first bitcoin block, the genesis block, had a 50 bitcoin pre-mine, but that bitcoin cannot be spend, which means that bitcoin did not have a pre-mine.

The distribution of bitcoin was fairer than that of Ether units, because of the lack of a pre-mine. Ethereum was heavily pre-mined, which was a get rich quick scheme for it's creators. The fairer, merit-based distribution means yet again, advantage bitcoin.

Summary

Let's recap what was discussed in this blog post in form of a table and with all this in mind, let's ask the million Satoshi question: What is the better money, Bitcoin, or Ethereum?

| Property | Bitcoin | Ethereum |

|---|---|---|

| Monetary Properties | Credibly sound | Questionable |

| Decentralization | Better | Worse |

| Distribution | Merit based, no pre-mine | enormous pre-mine |

| Scaling | Lightning, Liquid | No scaling solutions |

| Country adoption | El Salvador | None |

Bitcoin wins against Ethereum across all dimensions. It has sound monetary properties which are credible, it is better decentralized and it was and is distributed based on a meritocracy. Importantly, it has working scaling solutions in place. Bitcoin is legal tender in one country, today. Ethereum is not legal tender anywhere. Ethereum is worse as a money than bitcoin.

To me, the question between Bitcoin and Ether is easy to answer and I pick bitcoin for myself at any time. I have never owned Ether and very, very likely never will because I only care about sound money, which Ethereum is not, despite the marketing hype. A lot has to change for me to change my mind about that.

How About The Dollar Gains?

If you are interested purely in short term dollar gains, then buying Ethereum might be an option for you. I cannot say what the dollar price will do, no one can. It might go up or down or sideways, who knows. I am reasonably sure that bitcoin has a true shot at winning the battle against fiat currency in the long run. In the short term, market fluctuations might make Ethereum shine in dollar terms (or not).

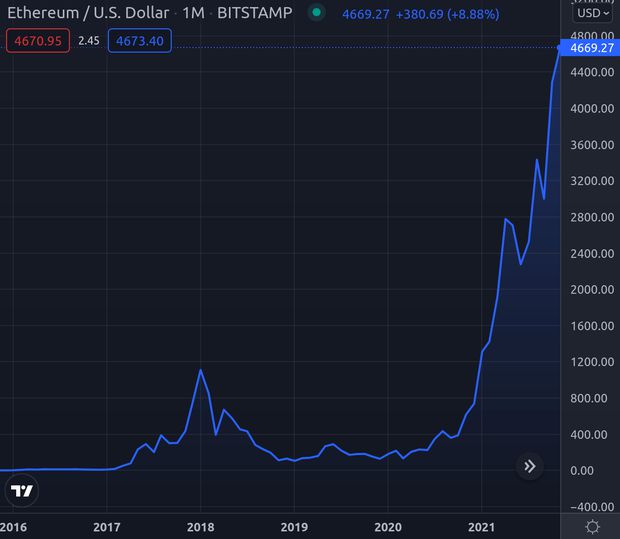

I don't care about dollar gains any more, only about my total number of satoshis (the smallest bitcoin units) and therefore I won't touch Ethereum. Relative to the dollar, it has performed fine overall:

Relative to bitcoin, on the other hand, Ethereum has not performed so well after the all time high in 2017, which has not been reached again since.

Short term, nobody knows what market fluctuations do. Anybody who says they know is lying to you. Long term, bitcoin has the stronger fundamentals. That's why I choose bitcoin over Ethereum. I think bitcoin will win against fiat currency.

I am not giving advice, mind you, I am only describing what I can see and I am telling you what I am doing, which is saving for the long term in bitcoin only. You have to decide for yourself what to do.

You have reached the end of Will Ethereum be worth more than bitcoin? Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of Will Ethereum be worth more than bitcoin? This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.