When I was a child, I must have been around 9 years old, I had a phase where I let it slack at school. I started cruising and it became evident in my grades. My parents took me aside and had a conversation with me because they wanted me to pick up the pace again.

I remember my father told me a story: Son, he said, suppose you’re in a track and field race running 5k in the Olympics and you want to win the race, of course. If you lose touch with the leader during the race, you need to run much harder and faster later to get back close to the lead. It’s not smart to run below your abilities if you want to get ahead. The story worked as intended; I remember it about 30 years later.

On a soft money standard (the US dollar/Euro fiat standard) you need to run infinitely harder and faster just to keep up with inflation. Investing in appreciating assets becomes important to maintain or increase purchasing power over time. Live on a hard money standard, on the other hand, is better, because you do not need to keep up with inflation. There just is no inflation on a hard money standard.

There are two kind of hard money advocates in the world. There are gold bugs and there are bitcoiners. Gold bugs like the shiny rock and think that gold should be the base money for a financial system. Bitcoiners agree with the core assumption of gold bugs: Hard money is better money. The two groups diverge when it comes to picking which hard money is the better option. Gold bugs chose gold. Bitcoiners chose bitcoin. This blog post unpacks the comparison between the two and explains, why I have chosen bitcoin over gold as my hard money.

Why Gold Has Failed As Money

Gold has some good properties as a money. It is durable and scarce. Digging it up requires a lot of work, which is why inflation of above ground gold supplies happens slowly at a rate of about 2 percent per year. That’s lower than the rate of fiat money inflation, which can just be printed, and which is around 6 to 8 percent per year in the better (harder) currencies.

But gold has some drawbacks. Gold is heavy and even a very small coin is quite valuable. Therefore, gold is not very well suited for daily transactions. That’s why gold backed certificates came into existence, paper money backed by 100 percent gold. The idea was, that gold is deposited into a warehouse and receipts against the deposit could be divided into smaller pieces and spend for small transactions. That worked well for a while, but the system ultimately failed for a couple of reasons. The biggest one is that gold reserves tended to be centralized on one place for convenience, the banking capital of the country. That was in Paris for France, in London for England and in New York for the U. S.

Centralization of reserves lead to governments co-opting them and the gold standard was “temporarily” suspended in 1914 to finance World War One. “Temporarily” turned out to be permanently in 1971 when Nixon shut the gold window. Since then, the world has operated on a fiat standard.

Why would a money technology, which has failed in the past “unfail” all of a sudden? To me, that’s a big argument not in favor of gold the same centralization tendencies that we had in the 19th and 20th century are still in place today. Gold, if used as a base money, will again be coerced and history will repeat. Fool me once, shame on you. Fool me twice …

Lost In The Wars

Suppose it is 1910. Pick a city on the globe and try to transmit your value, everything that you own, 100 years into the future to your grand, grand, grandchildren via gold deposits in a bank. Could you have done it in Paris? Nope, the Nazis came and took it. How about Berlin? Nope, the Nazis again. What about Tokyo? Japan lost World War Two. And New York? FDR made gold ownership illegal with executive order 6102 in 1934. Madrid? Dictator Franko came and took it from you. In Italy you had Mussolini. None of that was visible in 1910. London might have been the one exception, where you could have made it because the Germans never made it over the channel in World War Two. Other than that, it was impossible to maintain your value into the future because of government tyranny of one form or the other.

An Analogue Technology

Gold is analogue technology. It can be touched, is shiny and pleasant to look at, which is why it is used in jewellery and has a standing with the baby boom post war generation. Older people prefer gold. Because it is analogue, gold cannot be transacted over the internet. You can’t send it from the palm of your hand, using your phone, from one person the next. You cannot use it to pay digitally.

Younger People Prefer Bitcoin

That’s why young people prefer to use bitcoin. Young people are digitally native. They’ve grown up with the internet, they’ve had smart phones all their lives. They get value transfer online and why that’s a complete game changer. Let’s explain in two examples why bitcoin is superior to gold, being natively digital.

Tipping Over The Internet

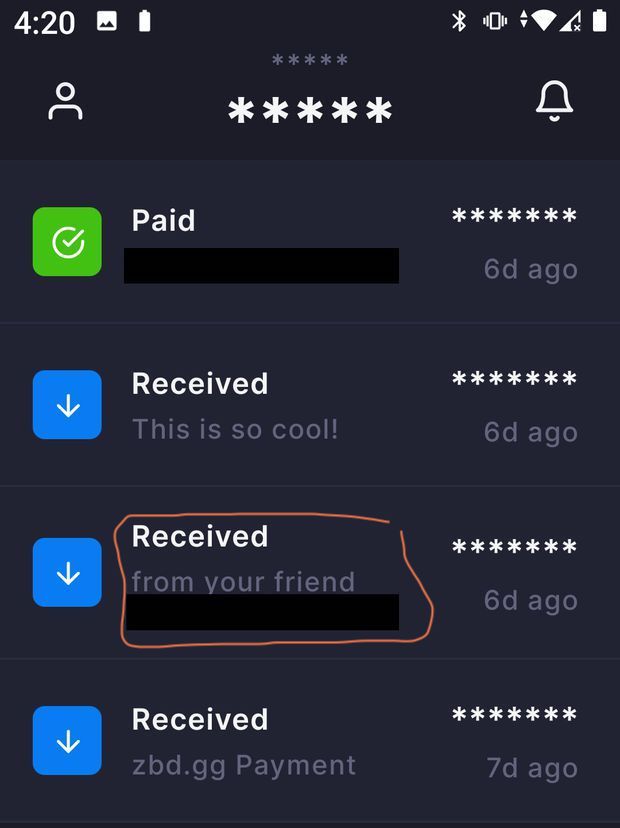

If you like my blog, you can send me a tip directly using the transaction layer lightning. To achieve that, you need a lightning setup or a lightning interoperable payment system. Strike accomplishes that in the United States right now. Using strike, a person can go to this link here and leave me a small tip from their bank account which arrives in my wallet instantly at next to no fees. Try doing that with gold.

Permissionless Cross Border Payments.

Using the same technology, you can pay anybody in the world instantly for services rendered. All they need is a lightning address. All you need is a lightning integrated payment solution such as strike. Remittances are a thing of the past.

That’s why young people own more bitcoin than they do gold, because they understand how digital value transfer is a game changer. They understand technology better than older people. Young people are the future bread winners and they adopt bitcoin as their money over gold.

Better Monetary Properties

Finally, bitcoin has superior monetary properties. Bitcoin scores better in terms of:

- Scarcity: Inflation is going to be zero in bitcoin.

- Decentralization: In contrast to easily centralized Gold, bitcoin is based on decentralization and tends to self decentralize. It is thus better protected from state level attacks by governments.

- Seizure resistance: It is possible to store bitcoin keys in multiple jurisdictions, which increases individuals protection from asset theft. The same is simply not possible with gold.

- Divisibility: Bitcoin can be subdivided. There are onehundred million subunits in each bitcoin. Gold lacks in that department too.

- Transferability: Permissionless, instant payments over the internet at the speed of light are possible with bitcoin. Gold? Not at all.

This Is Why I Bitcoin

In summary, I come to the conclusion that bitcoin moves faster than fiat currencies do and that bitcoin is harder than gold. It's the best money technology in history and that's why I save in bitcoin.

As an aside, while most people don't understand bitcoin properly and view it as a speculation, enormous returns for savers are possible. Here we calculate the 4-year savings return on a daily basis for one-time purchases and for periodic savings.

You have reached the end of Why bitcoin is better money than Gold Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of Why bitcoin is better money than Gold This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.