This blog post explains the pros and cons of storing bitcoin on an exchange and compares them with self-storage. What is easier? What is more convenient? What is safer? I go through these in detail. Exchange storage is convenient but comes with certain risks. Funds can be lost via phishing attacks, in hacks or via theft through rogue personnel. Mastering bitcoin self-storage removes these risks and is therefore the safer option but comes with a different set of challenges.

Is it Safe to Store Bitcoin on an Exchange?

The quick answer to this question is no, not when it matters. It seems safe for a while, until the event happens where you realize that it was not safe. And when it matters, it matters a lot. We're talking about money after all and there are no bailouts in bitcoin. Storing bitcoin on exchanges is convenient and easy. Noting needs to be done by the user to accomplish exchange storage.

The Pros and Cons of Storing Bitcoin on an Exchange?

It's easy and convenient to just leave bitcoin on your exchange.| Pros | Cons |

|---|---|

| Easy | Risky |

| Convenient |

How Can Bitcoin Be Lost on an Exchange?

Let's go into the details of losing bitcoin on an exchange. None of these risks will happen to you if you understand them and mitigate against them properly.

Phishing attacks

Attackers can get access to your login credentials by performing a phishing attack. The attackers make a website that visually resembles the exchange website and send you an email to login. The monitor all the login information and get access to your username and password. If you do not have 2 factor authentication enabled, that is enough information for the attacker so that they can steal your bitcoin. Because of that, you should always use 2 factor authentication with your exchange, as that's just way harder to phish.

You can still become a victim from phishing, even if you use 2 factor authentication, which is why I recommend against exchange storage for the medium or long term.

Theft

When your bitcoin is sitting on an exchange, it is no more than in IOU. You do not own bitcoin, you own a bitcoin IOU against the exchange owned bitcoin. The exchange and their personnel can steal your bitcoin from you. Recently, a South African bitcoin exchange made the news because the founders ran off with the money stored there. Rogue personnel can steal from your favorite exchange putting you at risk of losing money at any time.

That's another reason why you should withdraw your bitcoin from exchanges.

Hacks

Bitcoin itself cannot be hacked. It wouldn't function as money, if it could. But exchanges are not bitcoin. Exchanges can be hacked and hacks can lead to loss of funds. Mount Gox is one example in the space for an exchange that was hacked because it had poor security procedures in place. the hack resulted in the funds being drained away from Mount Gox and the "owners" of the bitcoin learning the hard way, what "not your keys not your coins" means. You only own bitcoin if you control the keys to the bitcoin yourself. otherwise, you own a bitcoin IOU and that is a fine thing to own until it isn't. And when it isn't anymore, it matters a whole lot because that money is gone forever.

The saying “not your keys, not your coins” has emerged after the Mount Gox hack to indicated the importance of bitcoin self storage. Again, there are no bailouts in bitcoin, which is by design. Bitcoin was made that way.

Government Confiscation

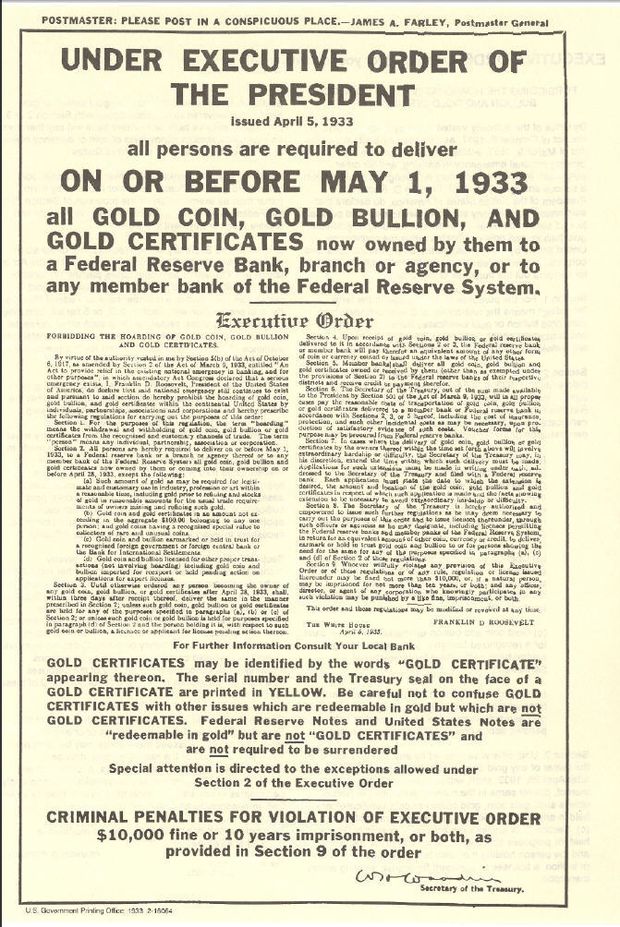

Governments around the world might one day want to confiscate bitcoin, when it becomes abundantly clear to most people why bitcoin is the best form of money in history. A confiscation of monetary assets is not without precedent. The United States President made ownership of gold illegal in 1933 through the executive order 6102.

That happened in the United States of America, which is arguably the freest country with the best property protection in the world. if 6102 expropriation can happen in the U.S. it can happen anywhere else too. That does not mean it will, but it is certainly a risk because it is possible.

Let's summarize the risks of bitcoin exchange storage:

- Government Confiscation

- Password Phishing Attacks

- Simple Theft by the exchange or their personell

- Exchange Hacks

Luckily, all of these risks can be mitigated against by self-storing your bitcoin.

How does Bitcoin Self Storage mitigate these risks?

When you store bitcoin yourself, you control the keys to that bitcoin and you become a monetary sovereign who does not rely on a third party. Your bitcoin cannot be stolen from you if it is sitting in self managed cold storage and your exchange gets hacked or you become victim of a phishing attack.

The Pros and Cons of Self Storage

| Pros | Cons |

|---|---|

| Safer | Can seem daunting |

| Risks from exchange storage disappear | Needs to be learned |

| Mistakes can result in loss of funds |

From Exchange Storage to Self-Storage

To achieve a state of being a fully self-sovereign bitcoin owner comes with a learning curve. Safe self-storage is a skill that needs to be learned. It's not hard to learn this skill, but it needs doing. That's fine and shouldn't frighten anybody, because it really isn't hard.

While you learn it is fine to initially leave your bitcoin on an exchange. Be aware of the risks that you are taking by doing so and learn self-custody as you purchase your first bitcoin.

Start with small amounts of money that you are comfortable losing in case you make a mistake and take custody of that money in a software wallet on your phone.

When you think you are ready to step up your bitcoin game, invest in a good cold storage setup with good backup habits. I have written about wallet options here to introduce the different wallet solutions in simple words.

A cold storage setup with a durable backup of the seed phrase is the best solution to mitigate all exchange storage risks. You can use exchanges as on ramps only by withdrawing straight into cold storage regularly, which is how you protect yourself from counterparty risk and assume responsibility.

I pull my bitcoin from exchanges regularly, making sure that it cannot be hacked or stolen from me. If a government chose to make bitcoin ownership illegal in my jurisdiction, I would move to a friendly jurisdiction in a heartbeat. 6102 risk is unlikely to be an issue, if you’re willing to move.

You have reached the end of Should I keep my bitcoin on an exchange or in a wallet? Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of Should I keep my bitcoin on an exchange or in a wallet? This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.