A high school friend heard about my blog and approached me the other day, asking me why bitcoin was the most popular cryptocurrency. Bitcoin is the only truly decentralized solution for money and thus the only competitor to the broken fiat currency system. No other cryptocurrency can rival bitcoin in terms of decentralization and network effect. Bitcoin also has the strongest brand and features an incredibly well thought out technology stack. Bitcoin is bedrock for the 21st century. There’s no second best. Let me explain this in detail:

Source: acinq.co.

Inception

Bitcoin was launched in 2009 as the first cryptocurrency by Satoshi Nakamoto. Satoshi was the first human to put together all the fragments for digital money in a way that worked long term. The bitcoin system has been working incredibly well ever since with unrivalled uptime and incredible resilience toward outside attack.

A fair launch

Bitcoin had an incredibly fair launch at inception. Satoshi made bitcoin a meritocracy without rewarding himself. Satoshi gave the code for bitcoin to the public and coupled the generation of new bitcoin with real world energy expense. You want bitcoin? You need to mine for them yourself expending energy or buy them at a dealer from somebody who mined them in the past. Mr Nakamoto mined in the early days of the network but he never assigned himself special tokens and anybody could join the network after launch and mine bitcoin for themselves. That is still true today. In contrast to launching bitcoin fairly, it has become quite common to pre-mine tokens in the cryptocurrency space. These tokens are oftentimes distributed to founders and investors before public launch. Ethereum for instance was pre-mined at about 70 percent making its founders wealthy ahead of the launch.

It is the only crypto that’s truly money

Bitcoin is money. In fact, it is the best money in human history. The same cannot be said for other cryptocurrencies. None of the other cryptos are money. Money is a winner take all market. There’s no second money. When you go pay in the supermarket, how many monies do they accept there? If you’re American, you pay with U. S. Dollars. You don’t pay with chuck e cheese tokens. Bitcoin is competing with the U.S. Dollar, the Euro, the Japanese Yen and the British pound to be the native global internet money. Bitcoin is not competing with other cryptocurrencies. The market as a whole understands that which is why bitcoin is trading much higher in terms of market size as any other cryptocurrency.

Decentralization

To stand a chance against government level attack by the biggest governments in the world, bitcoin needs to be decentralized. Not decentralized in name only, like most (maybe all) other cryptos. Running a bitcoin node at home can be done on your personal computer if you’ve got enough free hard drive space. Hardware for a dedicated node is available for about 300 dollars. A node can be operated using a Raspberry Pi 4 with a 1 terabyte external SSD drive or using a used 5-year-old computer running Linux. I am using a Lenovo m93p with a 1 TB SSD as my node. Either way, to run a node is fairly cheap. Reasonably soon, bitcoin nodes will be possible on smart phones. I am guessing that 2022 or 2023 the first practical smart phone node solutions will hit the market.

If we look at Ethereum, running an archive node (which is the Ethereum lingo for a full node) requires expert level computer skills and expensive hardware. It cannot be done on your home computer on the side because an archive node needs 8.7 terabytes of storage as I type this. Since January 1st, 1.7 terabytes were added to that database. If you read this in 6 months’ time or in a year, you can see here https://etherscan.io/chartsync/chainarchive to what the number is today. It’s going to be far more than 8.7 terabytes reasonably soon.

Therefore, Ethereum has way less full nodes than bitcoin does and is lacking in terms of decentralization. That makes bitcoin more resistant to government attack, which is important because governments might come and fight it. If they do, bitcoin is likely to win because of its decentralized nature. Bitcoin is the only truly decentralized cryptocurrency. Most (maybe all) others are decentralized in name only and need expensive servers to run. These servers can be cut off by governments. Bitcoin full nodes cannot.

The market is understanding that (as a whole) and the decentralization aspect is huge in terms of bitcoins popularity

The user base

Bitcoin has an almost religious user base. These users view it as their money. They’ve put in the time to understand why the alternative Fiat-Petrodollar-System is broken beyond repair and have decided to opt out if that system in favour of the upstart challenger Bitcoin. These users come in all sizes. Michael Saylor is one example as a public company CEO, who has understood why the dollar is broken and he has adopted bitcoin as his treasury reserve asset.

Max Keiser has been beating the drum for bitcoin since 2011 on his TV show The Keiser Report where he educates the public about the shortcomings of the petrodollar and why it will ultimately fail eventually.

Bitcoin has had the longest time to generate the biggest user base of all cryptocurrencies. Because of that past runway, more people own it then any other cryptocurrency which is why only bitcoin is digital money. We can see this trend very likely continue into the future, because money is a winner take all market. The Latin American country of El Salvador has made bitcoin legal tender and onboarded its 6 million citizens into the bitcoin network almost over night.

Network Effects

Bitcoin has more than one network effect. Network effects are very powerful protections against competition. How much is a single telephone worth? Nothing. But with a second and a third device in the world, you suddenly gain utility by being able to talk somebody at a distance. The telephone network is worth more to you as a participant in it, the more other people use it. If everybody is on it, you can call anybody. Networks with more participants are worth more, which is the network effect explained in a nutshell.

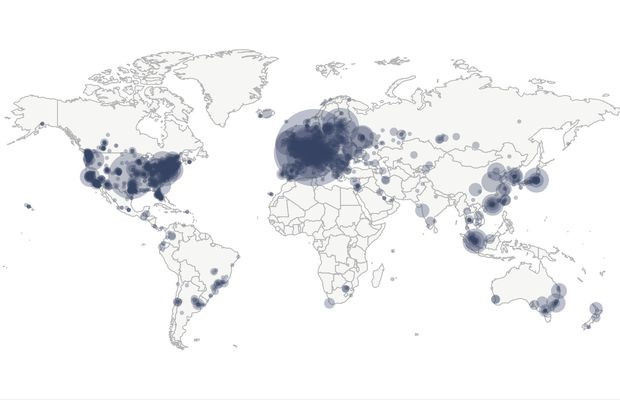

Bitcoins user base is its first network effect, just like in the telephone example. The second network effect comes from the network infrastructure. Bitcoin miners are purpose build machines that can do one thing only: defend the bitcoin network from attack by expending physical energy to calculate hash functions. The proof of work algorithm behind bitcoin drives its second network effect, the purpose build infrastructure which is useless for anything else but defending bitcoin against state level government attack.

The development team behind the bitcoin core software is another network effect in bitcoins favour. The biggest money attracts the brightest minds. The same is true for digital financial services companies. While a lot of the companies in the space support many altcoin offerings, bitcoin only companies have emerged. The same is not true for your favourite altcoin. Can you think of a filecoin only company? Examples for Bitcoin only companies are Swan and River Financial in the U.S. Get Bitrr in Europe and Bitaroo in Australia.

Finally, the bitcoin brand is a trillion-dollar brand. It may be the most expensive brand in history already and almost certainly will be one day. It is bigger than Coca-Cola, Apple or Nike and will be bigger than any other brand combined, which is an enormous advantage.

Superior Technology

If we compare bitcoin through the lens of money to any other cryptocurrency, we must conclude, that bitcoin is superior technology because bitcoin has been done right. It comes in layers, which is the basis for its success. The base layer protocol sacrifices transaction throughput for security by enabling decentralization of nodes and participants. You will never buy coffee on the base layer and that’s ok. The base layer has two jobs: One, it needs to be safe from world government interference and two it needs to provide settlement assurances. It accomplishes both.

To achieve scale, a second layer is running on top of the base protocol. The most important second layer is the lightning network. Lightning is a decentralized network of nodes with channels through which instant micro payments are possible. Lightning is where bitcoin buys you coffees. Or pizzas. Or whatever else you want to buy. When El Salvador is adopting bitcoin, most of that happens on the Lightning layer.

A similar solution does not exist in other cryptocurrencies.

Summary

In Summary, bitcoin is decentralized, secure money for the people with no close challenger. Bitcoin, in fact is the challenger to the U. S. Dollar and other debasing fiat currencies. It has more network effects then the second-best solution. In fact, there is no second-best solution. It’s bitcoin or nothing, which is why bitcoin is the most popular cryptocurrency. It is the only one that matters.

You have reached the end of Why is bitcoin the most popular cryptocurrency? Thank you for your attention.

Have you considered signing up for a bitcoin savings plan? If you set up one with Swan bitcoin you get 10 dollars for free with my referral.

Support Me

You've reached the end of Why is bitcoin the most popular cryptocurrency? This website was made and is maintained by Jogi. You can follow me on twitter here: @proofofjogi. You can also directly support bitcoin is the better money dot com by leaving me a tip if you would like to. Thank you for your support.